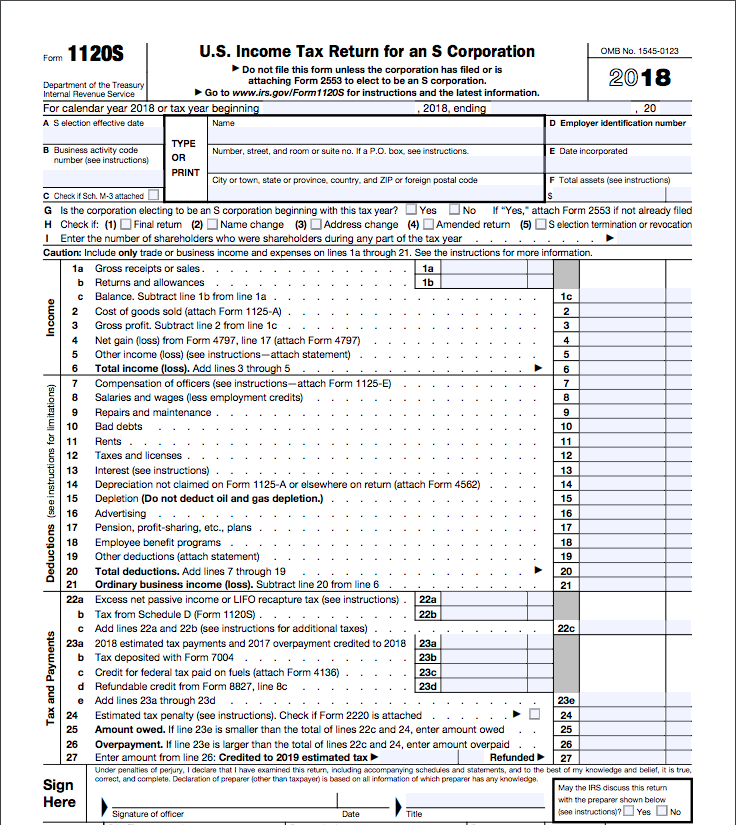

When Are 1120s Returns Due 2024. You must complete irs form 1120s to report your business’s income and expenses. For a fiscal year corporation, they are due by the 15th day of the 4th, 6th, 9th, and 12th months of the year.

Friday, march 15, 2024 s corporation. Income tax return for an s corporation by the 15th day of the third.

When Are 2024 Tax Extensions Due?

The statute of limitation for 2020 income tax returns (such as forms 1120, u.s.

For A Calendar Year Corporation, The Payments Are Due For 2024 By April 15, June 15, September 15, And December 15.

The deadline for filing form 1120s is:

All Of These Forms Are Due To The Irs On March 15,.

Images References :

Source: www.pdfprof.com

Source: www.pdfprof.com

1120s due date, The deadline for filing form 1120s is: The statute of limitation for 2020 income tax returns (such as forms 1120, u.s.

Source: www.zrivo.com

Source: www.zrivo.com

Form 1120S Extension 2023 2024, Irs begins accepting 1120 electronic tax returns. For individuals, that means you can still file for a tax extension right on april 15, 2024.

Source: www.accountantsinmiami.com

Source: www.accountantsinmiami.com

Tax Tips for Sub S Corporate Structures When There is a Distribution, For a calendar year corporation, the payments are due for 2024 by april 15, june 15, september 15, and december 15. Corporation income tax return) will generally expire in 2024.

Source: www.dochub.com

Source: www.dochub.com

1120 c tax form Fill out & sign online DocHub, Tax return due date 2024 mandy rozelle, the first tax returns for the season are due on march 15, 2024. All of these forms are due to the irs on march 15,.

Source: www.pdfprof.com

Source: www.pdfprof.com

1120s due date, Form 7004 can be filed on or before march 15, 2024, to request an automatic extension. When are 2024 tax extensions due?

Source: tabbyqlaurice.pages.dev

Source: tabbyqlaurice.pages.dev

When Will I Get My Tax Refund 2024 Canada Adore Mariska, 7) itr 6 is a tax return form for all the companies that. There's no final date for the transmission of electronic 1120 returns.

Source: www.pelhamplus.com

Source: www.pelhamplus.com

IRS Expected Return Over 168 Million in 2023 PelhamPlus, Form 7004 can be filed on or before march 15, 2024, to request an automatic extension. 7) itr 6 is a tax return form for all the companies that.

Source: www.pdfprof.com

Source: www.pdfprof.com

1120s due date, That is unless you file a tax extension or you reside in one of these states.although the irs has. You can continue to use 2022 and 2021.

Source: www.linkedin.com

Source: www.linkedin.com

1120S, 1065, and most LLC tax returns are due in one month March 16th, If the corporation's principal business, office, or agency is located in: Form 1065 (partnership) september 16, 2024:

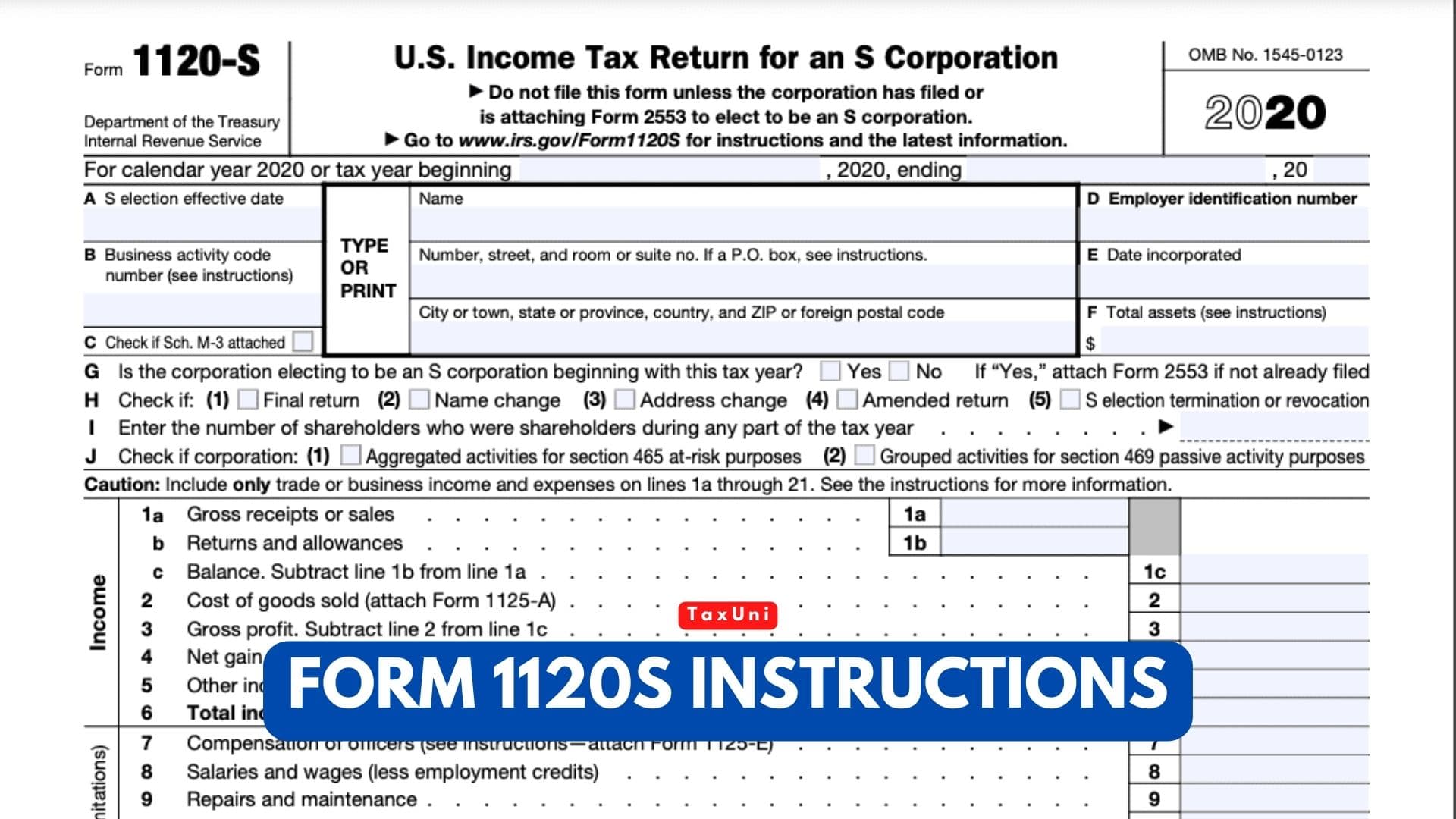

Source: www.taxuni.com

Source: www.taxuni.com

Form 1120S Instructions 2023 2024, However, these states don't have a perfection. Buy 2024 diary 2024 diary a5 page a day from jan.

This Form Shows The Overall Income, Deductions, And Credits Of The S Corp During The Tax Year.

That is unless you file a tax extension or you reside in one of these states.although the irs has.

7) Itr 6 Is A Tax Return Form For All The Companies That.

Friday, march 15, 2024 s corporation.