Estimated Tax Due Date 2024. Who needs to pay estimated taxes in 2024? The deadline for filing a federal tax return was 11:59 p.m.

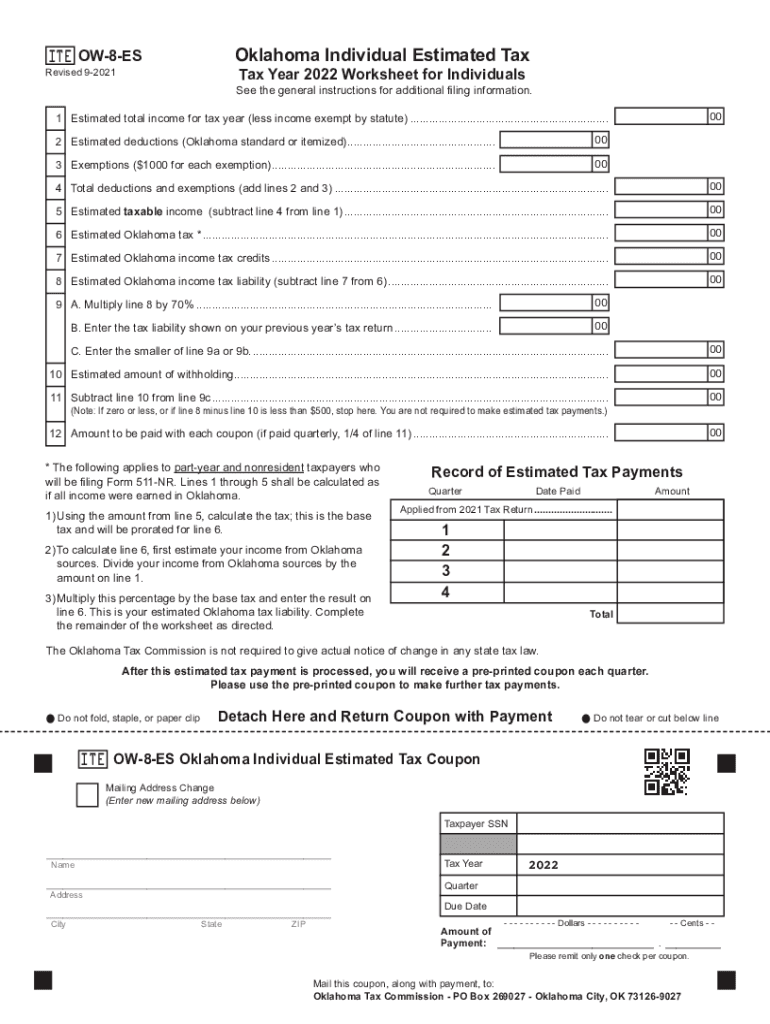

April 1 to may 31: You can make your quarterly tax payments.

Avoid A Penalty By Filing And Paying Your Tax By The Due Date, Even If You Can’t Pay What You Owe.

If you’re an individual, it might not be as.

Tds Payment For May 2024.

Knowing these dates will help ensure that you pay your taxes on time and.

Every Year, Estimated Tax Payment Deadlines Fall On Or Around The 15Th Of April, June, September, And January, With Small.

Images References :

Source: checkersaga.com

Source: checkersaga.com

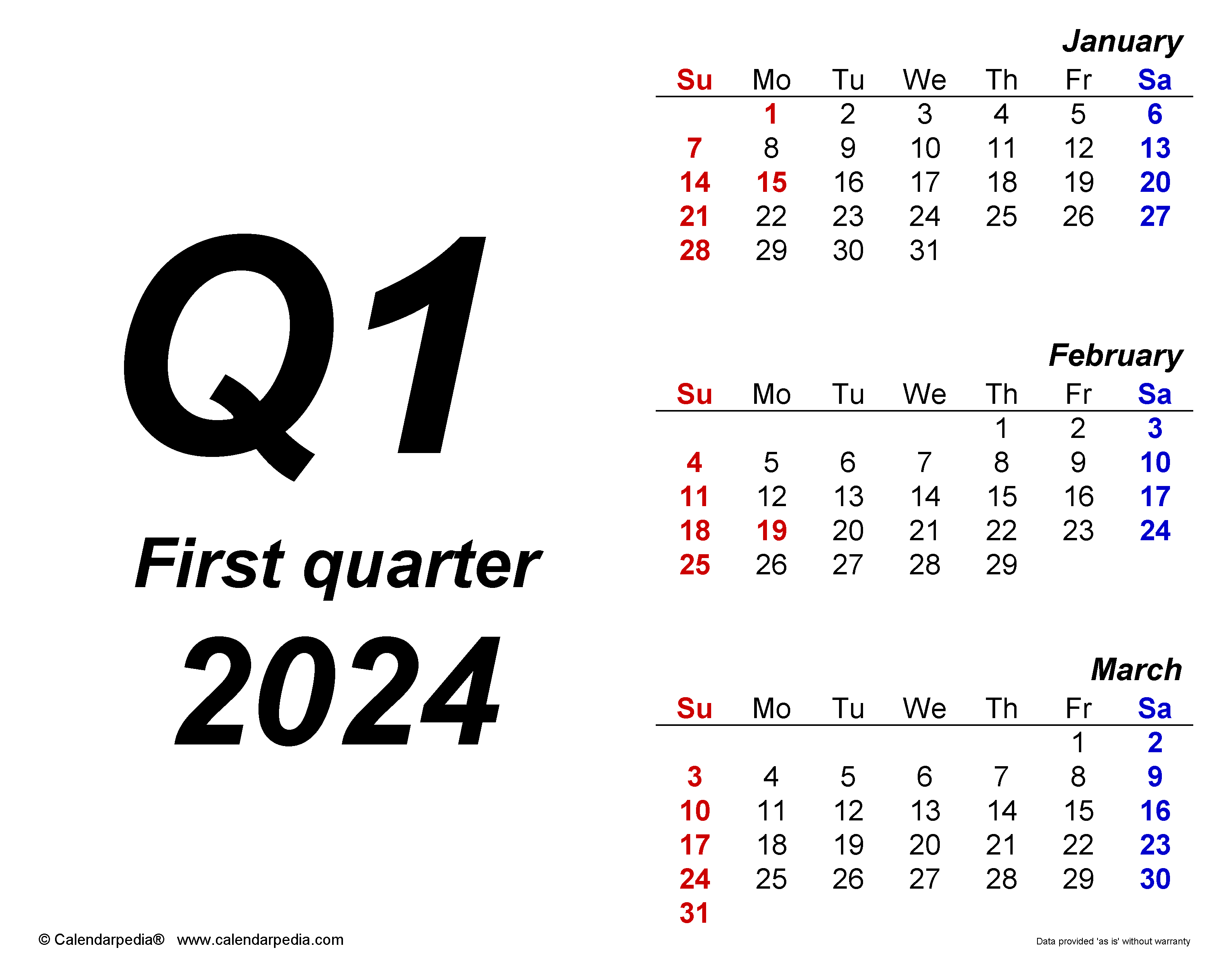

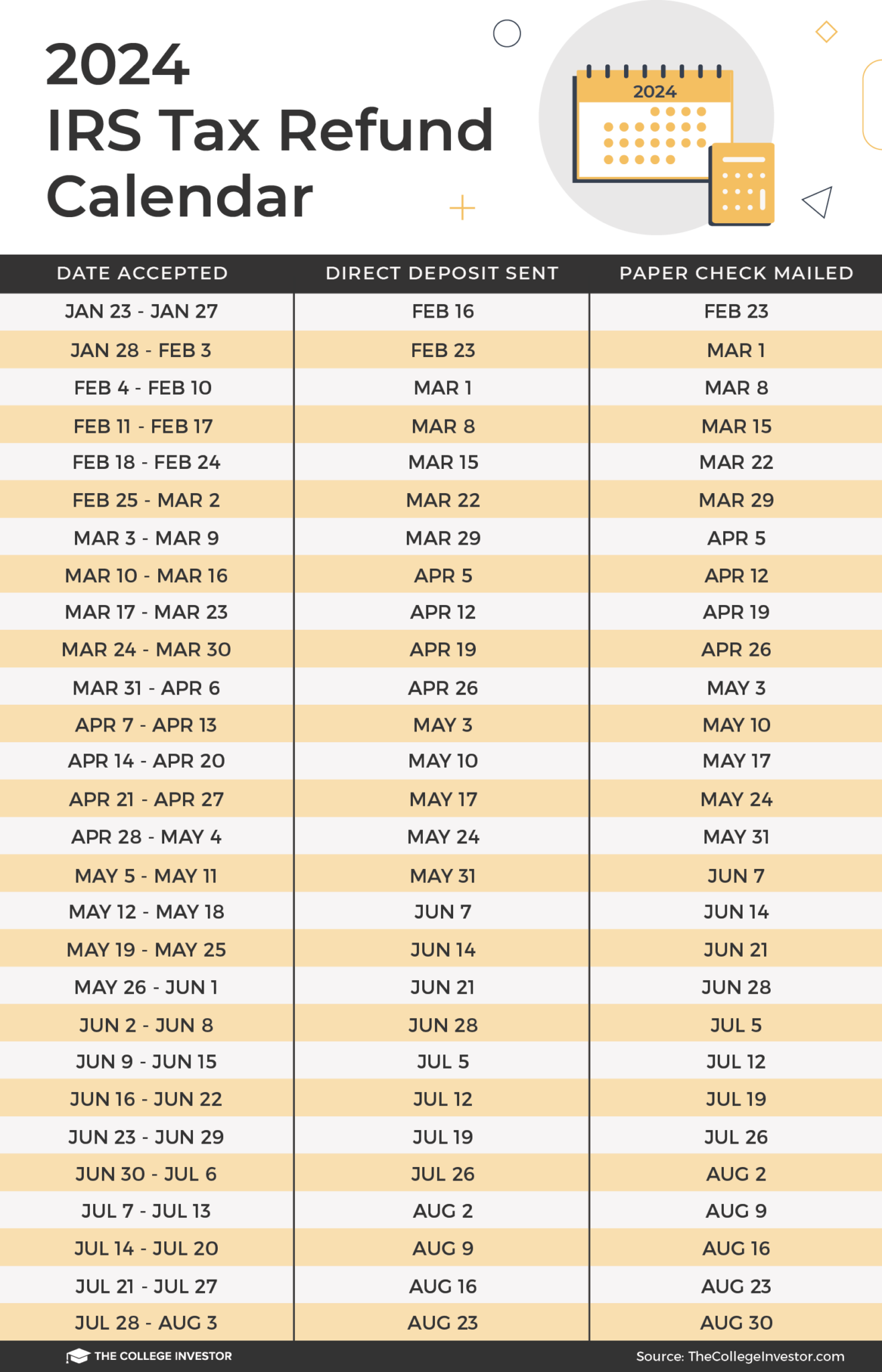

2024 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, For example, say your gross income for the prior year was $50,000, and it jumped up to $100,000 for the current year. You can make your quarterly tax payments.

Source: calendar-printables.com

Source: calendar-printables.com

Tax Due Date Calendar 2024 Calendar Printables, Following recent disasters, eligible taxpayers in tennessee, connecticut, west virginia, michigan, california and washington have an extended deadline for 2024 estimated tax payments until june 17, 2024. The table below shows the payment deadlines for 2024.

Source: brenqlindsay.pages.dev

Source: brenqlindsay.pages.dev

2024 Quarterly Estimated Tax Due Dates Mirna Tamqrah, You'd expect to owe at least $1,000 in taxes for the current year (after subtracting. The estimated tax payment deadlines for individuals in 2024 are as follows:

Source: livaqgeorgena.pages.dev

Source: livaqgeorgena.pages.dev

Irs Form 2024 Due Date 2024 dinah elbertina, If you’re an individual, it might not be as. Be sure to mark your calendar because federal income taxes are due on april 15 for 2024.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: karynacrissie.pages.dev

Source: karynacrissie.pages.dev

Tax Filing Deadline 2024 Us Minda Myrlene, For the 2023 tax year, the last estimated. Every year, estimated tax payment deadlines fall on or around the 15th of april, june, september, and january, with small.

Source: wallethacks.com

Source: wallethacks.com

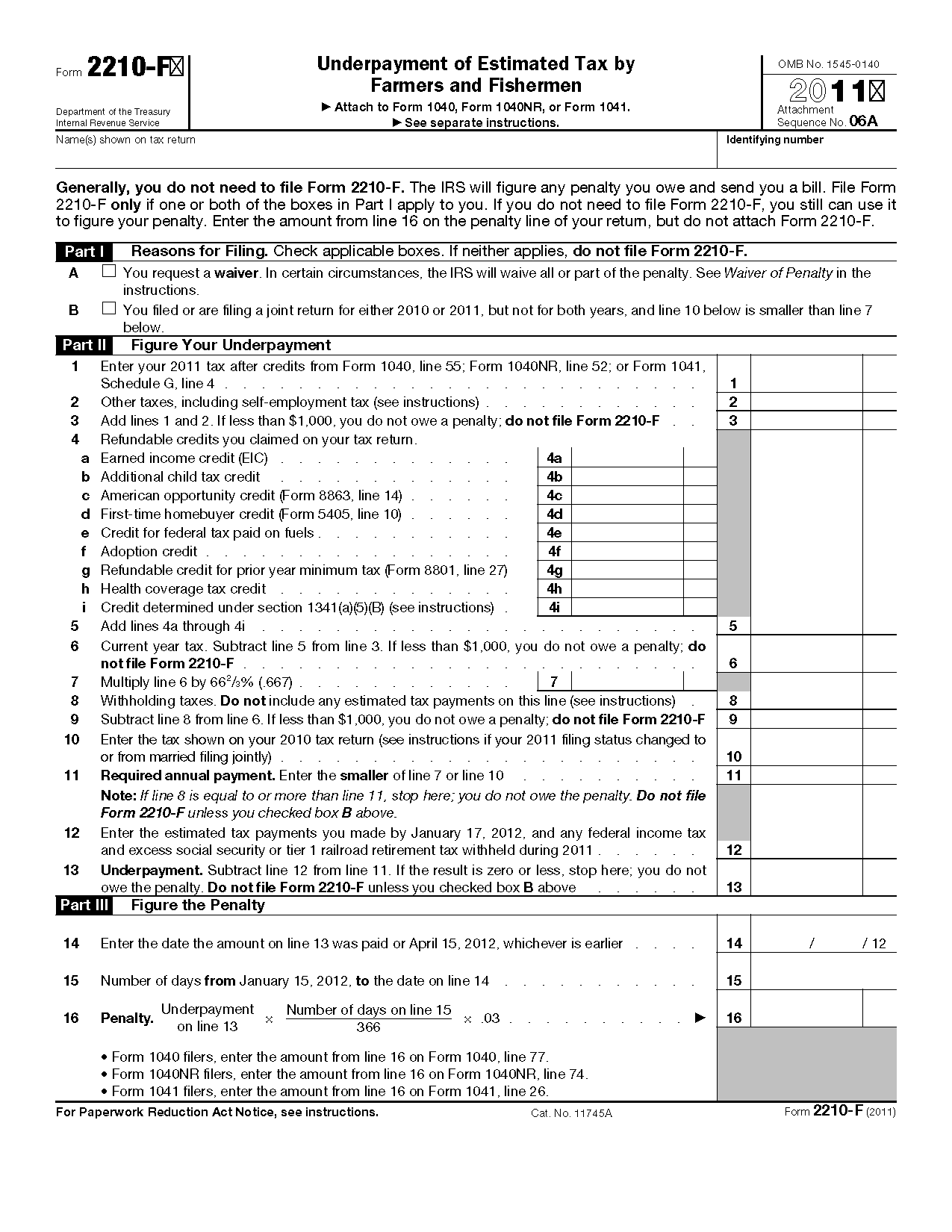

Estimated Taxes, Due Dates and Safe Harbor Tax Rules (2024), Annual tax filing deadlines for 2024. For corporations, it’s a pretty solid bet that estimated taxes will be required.

Source: kattiqrochelle.pages.dev

Source: kattiqrochelle.pages.dev

Corporate Taxes Due Date 2024 Edna Nichol, Get an extension when you make a payment. To get the extension, you must estimate your tax liability on this form and should also pay any amount due.

Source: colettawkalie.pages.dev

Source: colettawkalie.pages.dev

When Are Estimated Taxes Due 2024 Irs Jemima Rickie, Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. For example, say your gross income for the prior year was $50,000, and it jumped up to $100,000 for the current year.

Source: theadorawmarna.pages.dev

Source: theadorawmarna.pages.dev

Estimated Tax Payments 2024 Address Hetty Philippe, Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. There are four different deadlines throughout the year for estimated taxes in 2024.

Source: rgwealth.com

Source: rgwealth.com

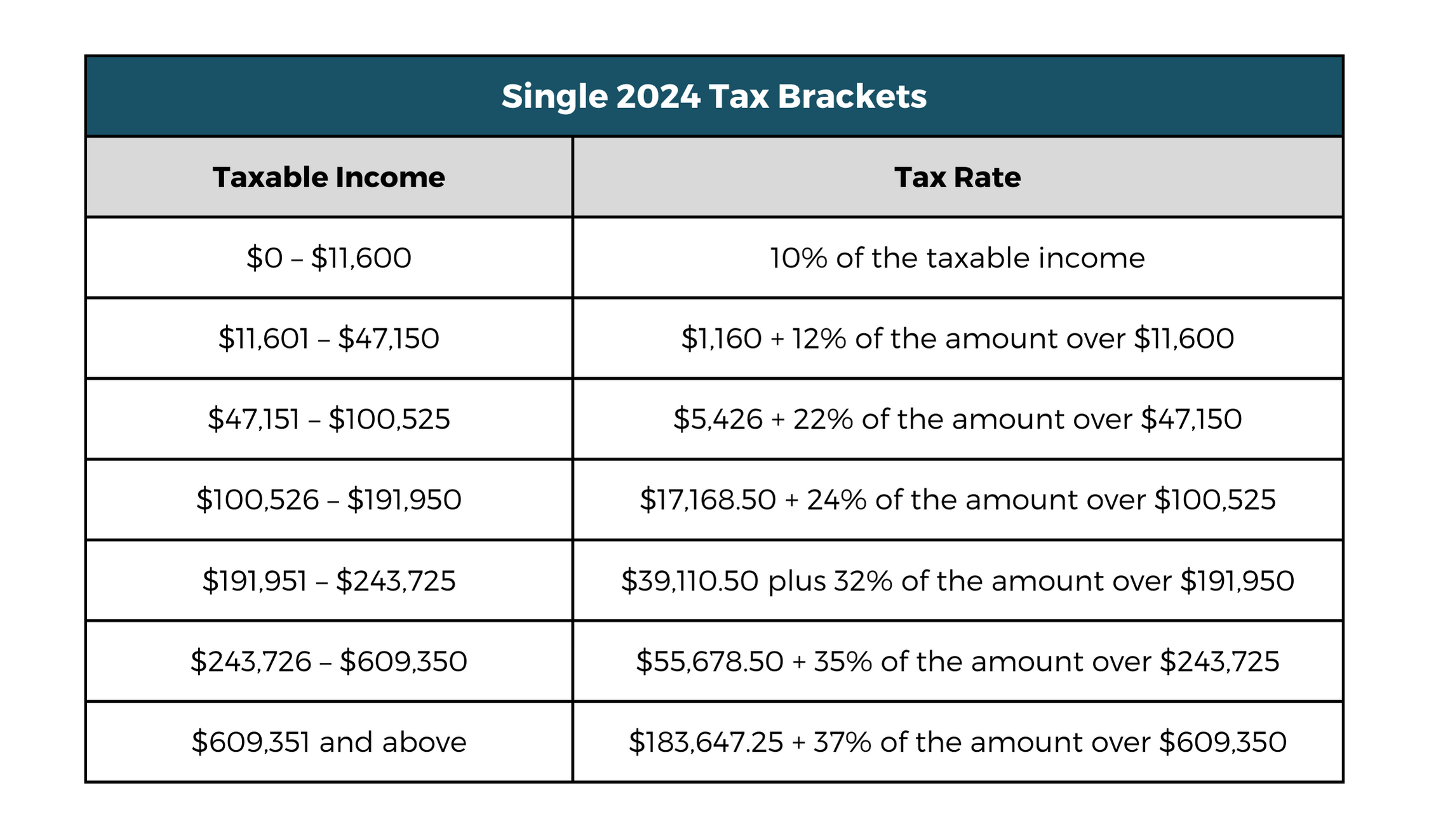

2024 Tax Code Changes Everything You Need To Know RGWM Insights, In 2024, estimated tax payments are due april 15, june 17, and september 16. When to pay estimated taxes for 2024.

Due Date Varies By State) 11Th June.

The deadline for filing a federal tax return was 11:59 p.m.

You Can Make Your Quarterly Tax Payments.

You’d expect to owe at least $1,000 in taxes for the current year (after subtracting.